Last month the Pennsylvania Supreme Court held that accessing any information from a cell phone without a warrant violates the fourth amendment to the constitution. The Fourth Amendment states in a nut shell that we shall be free from unreasonable searches and seizures. In this particular criminal case, the police powered on a cell phone that was recovered at the scene of an arrest. The police officers at the scene powered on the phone, determined its number, connected it to a crime and obtained a warrant to monitor a phone number that was found in the cell phone. This action ultimately led to the arrest of the owner of the cell phone that the police powered on without a warrant. The PA Supreme Court stated there is “no exception for what police or courts may deem a ‘minimally invasive search.” The Court reasoned that a person’s expectation of privacy rests in the phone itself and even went so far as to compare the opening and powering on of a cell phone as tantamount to walking through the front door of someone’s house without a warrant.

Last month the Pennsylvania Supreme Court held that accessing any information from a cell phone without a warrant violates the fourth amendment to the constitution. The Fourth Amendment states in a nut shell that we shall be free from unreasonable searches and seizures. In this particular criminal case, the police powered on a cell phone that was recovered at the scene of an arrest. The police officers at the scene powered on the phone, determined its number, connected it to a crime and obtained a warrant to monitor a phone number that was found in the cell phone. This action ultimately led to the arrest of the owner of the cell phone that the police powered on without a warrant. The PA Supreme Court stated there is “no exception for what police or courts may deem a ‘minimally invasive search.” The Court reasoned that a person’s expectation of privacy rests in the phone itself and even went so far as to compare the opening and powering on of a cell phone as tantamount to walking through the front door of someone’s house without a warrant.

Protection of Digital Rights

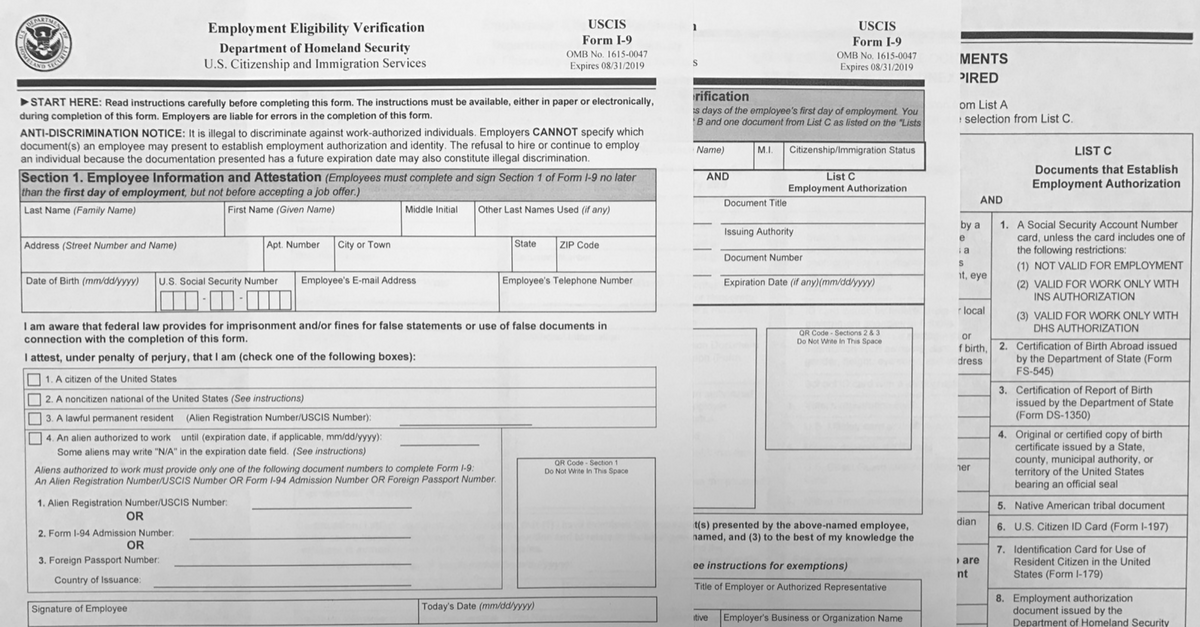

The Pennsylvania Supreme Court’s decision continues the movement towards the protection of digital rights. While this case centered on criminal activity, it has clear implications in the business world. SEC or DOJ investigations, internal audits and civil litigation will be impacted by this decision. With virtually every adult in the business world possessing a cell phone, understanding one’s rights and obligations in this digital world can mean the difference between jail and freedom, termination for cause versus without cause, or turning over trade secrets when you are under no obligation to do so. The laws that encompass digital privacy are rapidly changing. Indeed, I have had several New Jersey litigation cases where opposing counsel was not aware of New Jersey’s Social Media Law that prohibits employers from requiring employees to provide access to their social media accounts (5th amendment issues). Without this information, opposing counsel was not able to access the information needed to prove her case.

Blog: News & Legal Articles from Our Team

Blog: News & Legal Articles from Our Team